New Construction Starts in December Rebound 12 Percent; Annual Total for 2017 Advances 3 Percent to $745.9 Billion

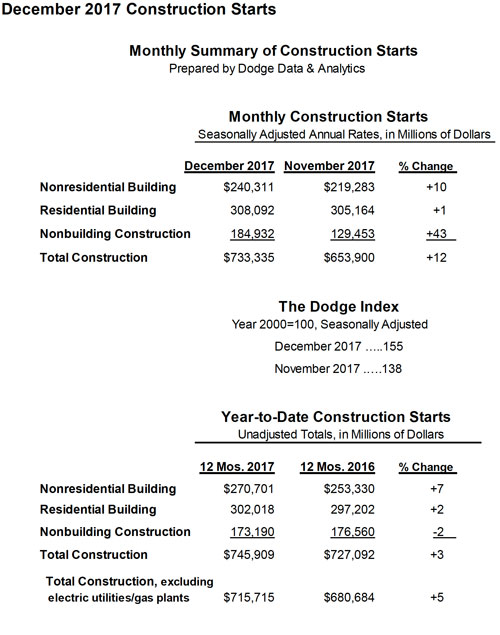

NEW YORK – January 25, 2018 – New construction starts in December climbed 12% to a seasonally adjusted annual rate of $733.3 billion, bouncing back following November’s 12% decline, according to Dodge Data & Analytics. December’s gain for total construction reflected varied improvement by each of the three main construction sectors. Nonbuilding construction (public works and electric utilities/gas plants) jumped 43%, lifted by the start of the $2.3 billion I-66 Corridor Improvements Project in northern Virginia. Nonresidential building rose 10%, aided by the start of two large data center projects, while residential building edged up 1%. For all of 2017, total construction starts grew 3% to $745.9 billion, which followed the 6% increase reported for 2016. The full year 2017 gain was dampened by a 35% downturn for the electric utility/gas plant category. If electric utilities and gas plants are excluded, total construction starts for 2017 would be 5% higher than the corresponding amount for 2016.

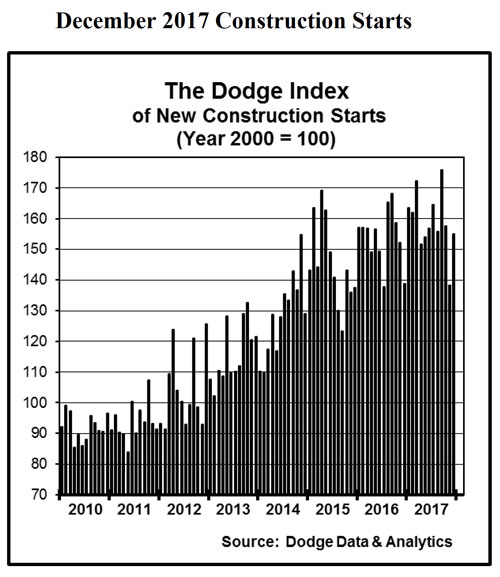

The December statistics produced a reading of 155 for the Dodge Index (2000=100), up from November’s 138. For the full year 2017, the Dodge Index averaged 158. “After weaker activity was reported in both October and November, the December rebound for total construction starts eased the extent of the decline that took place during the fourth quarter,” stated Robert A. Murray, chief economist for Dodge Data & Analytics. “On a quarterly basis, growth in 2017 was reported during the first and third quarters, while activity retreated during the second and fourth quarters, continuing the up-and-down pattern around an upward trend that was present during 2016. On the positive side for 2017, institutional building assumed a leading role in keeping the nonresidential building expansion going, reflecting elevated activity for transportation terminal starts and further improvement by educational facilities. Manufacturing plant construction starts strengthened, ending a two-year decline, and commercial building was able to stay close to its heightened 2016 amount. Residential building in 2017 showed more growth for single family housing, offsetting a downturn for multifamily housing. And, public works construction in 2017 was able to strengthen, helped by the start of several very large pipeline projects and a moderate gain for highway and bridge construction.”

“The construction industry over the past two years has made the transition to a more mature stage of expansion, characterized by slower rates of growth for total construction compared to the 11% to 13% yearly gains during the 2012-2015 period,” Murray indicated. “For 2018, the construction expansion is anticipated to continue at a modest pace. The tax reform package is expected to provide a near term lift to overall economic growth, and the likely beneficiaries would be commercial building and multifamily housing. Funding support for institutional building will come from the state and local bond measures passed in recent years. Passage of a new infrastructure program at the federal level could be a plus for public works, although the impact at the construction site is likely to be felt more in 2019 than in 2018, as the program would feature incentives to boost funding from state, local, and private sources.”

Nonresidential building in December was $240.3 billion (annual rate), up 10% from the previous month. The commercial building categories as a group advanced 17%, as a 42% hike for office buildings provided much of the lift. December office starts included two large Facebook data centers – a $750 million project in Sandston VA and a $400 million project in Prineville OR. In addition, a $248 million office tower as part of the Amazon Block 21 Development in Seattle WA reached groundbreaking. Warehouse construction in December climbed 12%, and included the start of a $140 million logistics park in Staten Island NY, a $111 million Wal-Mart distribution center in Bentonville AR, and an $82 million Amazon fulfillment center in Memphis TN. Hotel construction in December grew 5%, with support coming from the start of a $136 million JW Marriott hotel in Anaheim CA. However, slight declines were reported in December for commercial garages, down 1%; and store construction, down 2%.

The institutional building categories as a group increased 9% in December. Healthcare facilities climbed 29%, and included three very large projects – a $300 million addition to a medical center in Fort Myers FL, a $150 million new hospital tower in Leesburg VA, and a $109 million addition to a hospital in Cherry Hill NJ. The other major institutional category, educational facilities, receded 7% in December following its 13% November gain. Large educational facilities projects that reached groundbreaking in December were led by a $135 million middle school in Sparks NV, a $90 million science and technology building at Virginia Polytechnic Institute in Roanoke VA, and an $87 million business and behavior science building at Clemson University in Clemson SC. The smaller institutional categories showed stronger activity in December. Public buildings (courthouses and detention facilities) increased 89% after a weak November, helped by the start of a $196 million judicial complex in Joliet IL. The transportation terminal category rose 42%, and included the $246 million National Hall security facility project at Reagan National Airport in Washington DC. Modest gains in December were reported for religious buildings, up 4%; and amusement-related work, up 3%. The manufacturing plant category fell 37% in December, although the latest month did include the start of a $150 million chemical research facility in Newark DE and a $125 million LG electronics factory in Clarksville TN.

For 2017 as a whole, nonresidential building advanced 7% to $270.7 billion. The institutional building categories as a group climbed 14%, a stronger gain than the 9% increase reported during 2016. Transportation terminal work had a banner year in 2017, as new construction starts soared 121%. Noteworthy transportation terminal projects that reached groundbreaking were led by two projects at LaGuardia Airport in New York NY – the $4.0 billion Delta Airlines Terminal and the $3.4 billion Central Terminal replacement project. The next three largest transportation terminal projects were the $1.9 billion Delta relocation to Terminals 2 and 3 at Los Angeles International Airport, the $1.3 billion Farley Train Hall redevelopment in New York NY, and the $1.2 billion South Terminal C project (phase 1) at Orlando International Airport. The educational facilities category in 2017 increased 6%, as college and university construction starts jumped 20% after experiencing a 3% decline in the previous year. Large college and university projects that reached groundbreaking in 2017 included a $421 million research laboratory at the University of California in Merced CA and a $327 million school of engineering and applied sciences at Harvard University in Allston MA. The K-12 portion of the educational facilities category rose 5% in 2017, a smaller gain than the 14% increase during the previous year. The top five states for K-12 school construction in 2017, with their percent change from the previous year, were the following – Texas, down 4%; New York, up 24%; California, up 13%; Washington, up 43%; and Ohio, up 9%. Healthcare facilities in 2017 improved 1%, and included 43 projects valued each at $100 million or more, led by the $1.4 billion Penn Medicine Patient Pavilion in Philadelphia PA and a $550 million medical center in St. Louis MO. Additional gains in 2017 were reported for religious buildings, up 13% (after a very weak 2016), and public buildings, up 6%. The amusement-related category fell 6% in 2017 after a 28% jump in 2016 that included the start of the $3.0 billion football stadium for the Los Angeles Rams and Los Angeles Chargers in Inglewood CA. Several large amusement-related projects did reach groundbreaking in 2017, led by the $1.2 billion expansion of the Javits Convention Center in New York NY, the $1.1 billion retractable-roof baseball stadium for the Texas Rangers in Arlington TX, and the $562 million arena portion for the Golden State Warriors that’s part of the $1.0 billion Chase Center complex in San Francisco CA.

The commercial categories as a group slipped 3% in 2017, after surging 22% in 2016. Store construction and commercial garages registered the largest declines, with each falling 10%. Hotel construction dropped 5%, following a 28% jump in 2016 that included the $465 million hotel portion of the $1.7 billion Wynn Casino in the Boston MA area. There were still several large hotel projects that reached groundbreaking in 2017, such as the $575 million hotel portion of the $900 million Seminole Hard Rock Hotel expansion in Hollywood FL and the $342 million hotel portion of the $500 million Resorts World Hotel and Casino in Las Vegas NV. Office construction receded 2% in 2017 after registering a 29% gain in 2016 that included the $2.0 billion 3 Hudson Boulevard office building and the $1.5 billion One Vanderbilt Tower, both in New York NY. Large office projects that reached groundbreaking in 2017 included the $1.7 billion 50 Hudson Yards office building in New York NY, the $780 million office portion of the $1.3 billion Oceanwide Center complex in San Francisco CA, and the $750 million Facebook data center in Sandston VA. The top five metropolitan areas in 2017 ranked by the dollar amount of new office construction starts, with their percent change from the previous year, were – New York NY, down 33%; San Francisco CA, up 132%; Washington DC, up 10%; Dallas-Ft. Worth TX, down 21%; and Atlanta GA, up 27%. Warehouse construction was the one commercial project type to register a gain in dollar terms during 2017, increasing 10%, which reflected the start of numerous Amazon fulfillment centers. The manufacturing plant category advanced 21% in 2017, following declines of 30% in 2015 and 20% in 2016. Petrochemical plant starts increased substantially in 2017 after a two-year slide, and included such projects as a $6.0 billion ethane cracker facility in Pennsylvania and a $1.8 billion methanol plant in Louisiana.

Residential building in December was $308.1 billion (annual rate), up 1%. The single family side of the housing market rose 1%, continuing to show the modest improvement that’s been present during the second half of 2017 after the slight loss of momentum reported last spring. Multifamily housing in December was unchanged from its November pace. December featured groundbreaking for four large multifamily projects valued each at $100 million or more – the $224 million multifamily portion of a $380 million mixed-use building in San Francisco CA, a $220 million apartment building in New York NY, the $217 million multifamily portion of a $275 million mixed-use building in San Diego CA, and a $123 million apartment building in Minneapolis MN.

The 2017 amount for residential building was $302.0 billion, a 2% gain that followed a 9% increase in 2016. Single family housing maintained its moderate upward track, rising 8% which matched its rate of growth in dollar terms for 2016. By geography, single family housing in 2017 showed this pattern for the five major regions – the South Atlantic, up 12%; the South Central and West, each up 8%; the Midwest, up 5%; and the Northeast, down 2%. Multifamily housing in 2017 headed in the opposite direction, falling 12% after seven straight years of expansion. New York NY, the nation’s leading multifamily market by dollar volume, registered a relatively modest 4% decline in 2017, after sliding a substantial 27% in 2016. However, the pullback for multifamily housing broadened on a geographic basis during 2017, as 7 of the remaining 9 metropolitan markets in the top ten showed weaker activity, with only San Francisco CA and Atlanta GA reporting gains. Rounding out the top five multifamily markets by the 2017 dollar volume, with their percent change from 2016, were the following – Los Angeles CA, down 17%; Washington DC, down 23%; Chicago IL, down 24%; and San Francisco CA, up 3%. Multifamily markets ranked 6 through 10 showed this performance – Boston MA, down 29%; Atlanta GA, up 26%; Miami FL, down 50%; Seattle WA, down 10%; and Dallas-Ft. Worth TX, down 26%.

Nonbuilding construction in December was $184.9 billion (annual rate), rebounding 43% after a 31% plunge in November. The public works categories as a group climbed 37%, with increases reported for most of the project types. Highway and bridge construction soared 66% in December, with the boost coming from the $2.3 billion I-66 Corridor Improvements Project in northern Virginia, as well as the $547 million Southern Gateway highway upgrade project in the Dallas-Ft. Worth TX area. The river/harbor development category jumped 155% in December, lifted by the start of a $278 million channel maintenance and dredging project in Charleston SC. Sizeable gains were also reported for sewer construction, up 35%; and water supply construction, up 25%; with the latter aided by the December start of a $233 million water purification plant expansion in Houston TX. Miscellaneous public works was the one public works category to retreat in December, sliding 11% from November which included the $2.0 billion Purple Line mass transit project in the Washington DC metropolitan area. Despite the decline, the miscellaneous public works category in December did include the start of the $1.0 billion EPIC oil pipeline and storage facility project in Texas, with the pipeline running from the Permian Basin shale field to the Gulf of Mexico. The electric utility/gas plant category jumped 93% in December, reflecting the start of a $992 million transmission line project in California, plus the start of a $750 million power plant in North Carolina and a $229 million power plant in Massachusetts.

For the full year 2017, nonbuilding construction dropped 2% to $173.2 billion. The nonbuilding decline was mostly the result of the 35% plunge for the electric utility/gas plant category, which continued to retreat after its most recent peak in 2015. Although the dollar amount for conventional power plant starts increased 6% in 2017, other power generation projects including solar and wind fell 49%, and the amount of gas plant construction starts was negligible by recent standards. The public works project types as a group grew 10% in 2017, with a large share of that increase coming from 35% growth for the miscellaneous public works category. If miscellaneous public works is excluded, the remaining public works categories together would be up only 1% in 2017. The miscellaneous public works category benefitted from an exceptionally strong amount of new pipeline projects, totaling $21.6 billion in 2017, and including such projects as the $4.2 billion Rover natural gas pipeline located mostly in Ohio and the $3.0 billion Atlantic Sunrise natural gas pipeline expansion located mostly in Pennsylvania. Rail mass transit construction starts, totaling $9.6 billion in 2017, also lifted the miscellaneous public works category. Highway and bridge construction starts grew 7% in 2017, strengthening after a 9% decline in 2016. The top five states in 2017 ranked by the dollar amount of new highway and bridge construction starts, with their percent change from the previous year, were – Texas, down 20%; California, up 9%; Virginia, up 180%; Florida, up 23%; and Pennsylvania, up 32%. The environmental public works categories registered decreased activity in 2017, with river/harbor development down 2%, sewer construction down 10%, and water supply construction down 17%.

The 3% increase for total construction starts at the national level in 2017 was the result of mixed behavior by geography. The Northeast climbed 17%, aided by strong gains for its institutional building sector and natural gas pipelines, while more moderate total construction growth was reported for the South Atlantic, up 6%; and the West, up 3%. Total construction declines in 2017 were reported for the South Central, down 3%; and the Midwest, down 8%.

About Dodge Data & Analytics

: Dodge Data & Analytics is North America’s leading provider of analytics and software-based workflow integration solutions for the construction industry. Building product manufacturers, architects, engineers, contractors, and service providers leverage Dodge to identify and pursue unseen growth opportunities and execute on those opportunities for enhanced business performance. Whether it’s on a local, regional or national level, Dodge makes the hidden obvious, empowering its clients to better understand their markets, uncover key relationships, size growth opportunities, and pursue those opportunities with success. The company’s construction project information is the most comprehensive and verified in the industry. Dodge is leveraging its 100-year-old legacy of continuous innovation to help the industry meet the building challenges of the future. To learn more, visit www.construction.com.